Yield as a Risk Signal

The market pays more when risk is higher.

Yield is the price paid to hold risk. In tradfi, an investor would typically start with a base “risk-free” rate, usually government bills, and understand that anything above this rate represents compensation for incremental bundles of risks, including credit, liquidity, duration, geopolitical, funding, and others.

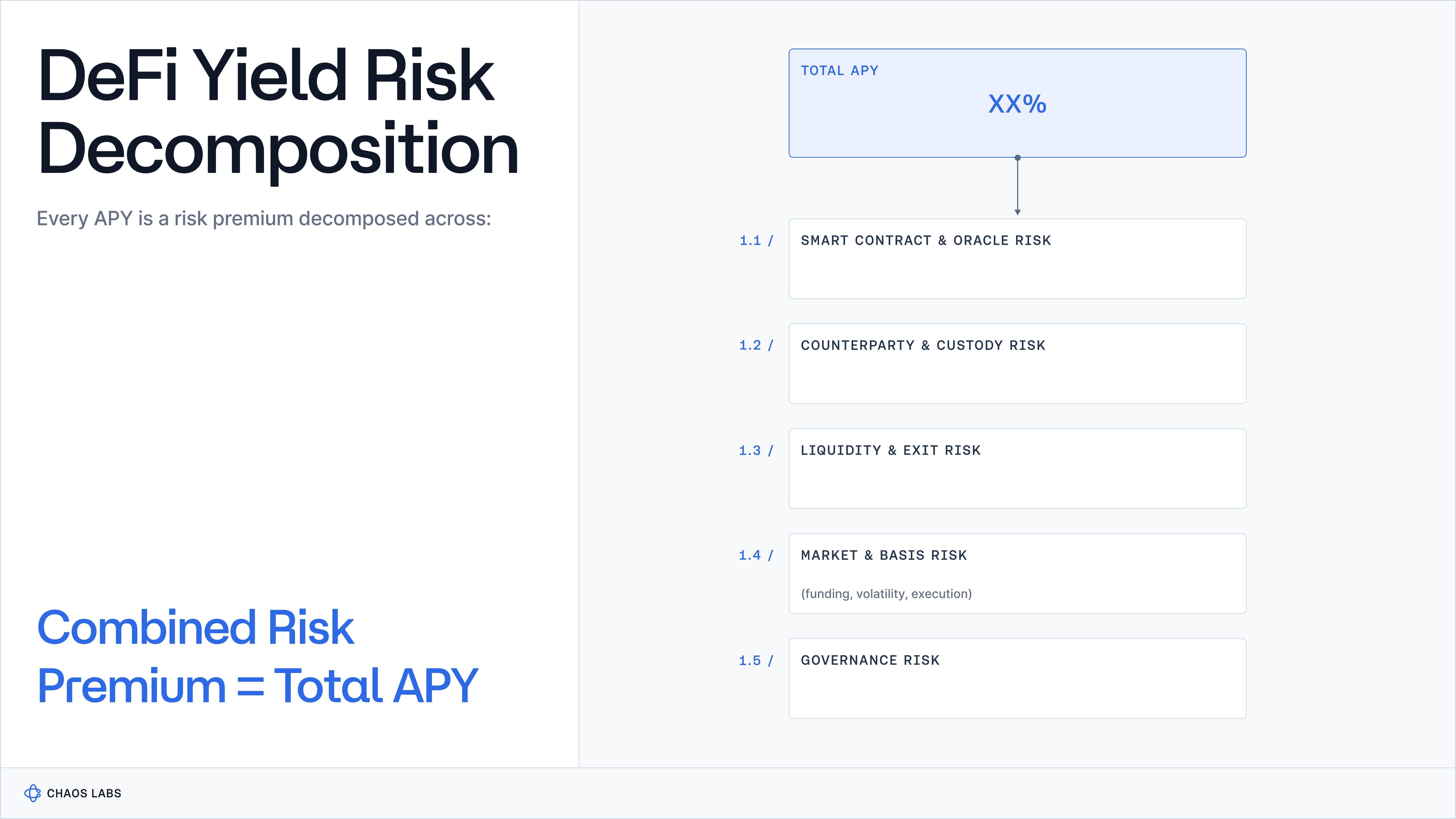

DeFi is no different, except it lacks a true risk-free asset, and nearly all marketed APYs are risk premiums decomposed across:

- Smart contract and oracle or infra risk

- Counterparty and custody risk

- Liquidity risk

- Market and basis risk, including funding, volatility, and execution

- Governance risk

At times, markets misprice this bundle; other times, protocols over-incentivize early usage through aggressive token rewards. In many cases, DeFi yields exceed the risks visible to the user at the time of allocation.

This doesn’t imply that all yield is bad.

To the contrary, yield should be reframed as a “signal.” A double-digit APY indicates that the market is asking someone to warehouse risk. If that risk is understood, fits within a defined risk budget, and appears mispriced in the user’s favor, it could represent a rational trade.

Problems emerge when the link between yield and risk weakens, particularly in environments where “safe” yields compress across the rest of the market.

Yields Compressed, Risk Appetite Didn’t

Over the past months, we’ve seen some compression in DeFi yields.

Falling US interest rates and the perceived “altcoin winter” have impacted some of the more prominent yield opportunities.

- On one side, this has attracted a new slate of professional traders offering curated and structured yield products.

- On the other, it has also pushed yield-seeking degens to accept additional risk in order to sustain headline APYs.

It doesn’t help that most DeFi yield seekers are also anchored to the golden era of 2023-early 2025, when 20% APY on relatively conservative stablecoin strategies was common. A shift from that benchmark down to 4-6% feels like a material loss, despite the change in risk conditions.

We see this reflected in several ways:

- Rotation out of plain vanilla lending into more opaque, leveraged, and structured products

- Increased appetite for rewards, airdrop points, and yields “boosted” by upside optionality

- A willingness to ignore complexity and path dependence as long as headline APY remains attractive

In summary, compression at the low-risk end of the curve shifts allocation toward structurally riskier positions evaluated against prior safety benchmarks.

MM Vaults on Perp DEXs: “House Edge Wrappers”

Against this backdrop, market-making vaults on perp DEXs have become a prominent destination for yield-seeking capital.

At a high level, these are liquidity-providing vaults where users deposit stablecoins and earn yield generated by a vault acting as an AMM on a perp DEX. The strategy quotes bids and asks, takes the other side of trader flow, and dynamically manages inventory.

Yield is typically composed of a mix of trading fees from taker flow, PnL from trader losses and liquidations, and protocol incentives, whether through token emissions or, in the current cycle, points and airdrop eligibility. Because these MM LP vaults are essentially wrappers around “the house edge,” they are increasingly treated as low-risk, near cash-like products. For some users, these products occupy the same mental category as vanilla lending deposits, conservative basis trades, and short-duration t-bill wrappers.

However, while the existence of a house edge in markets is real, it comes with important caveats.

The Path to Edge Is Nonlinear

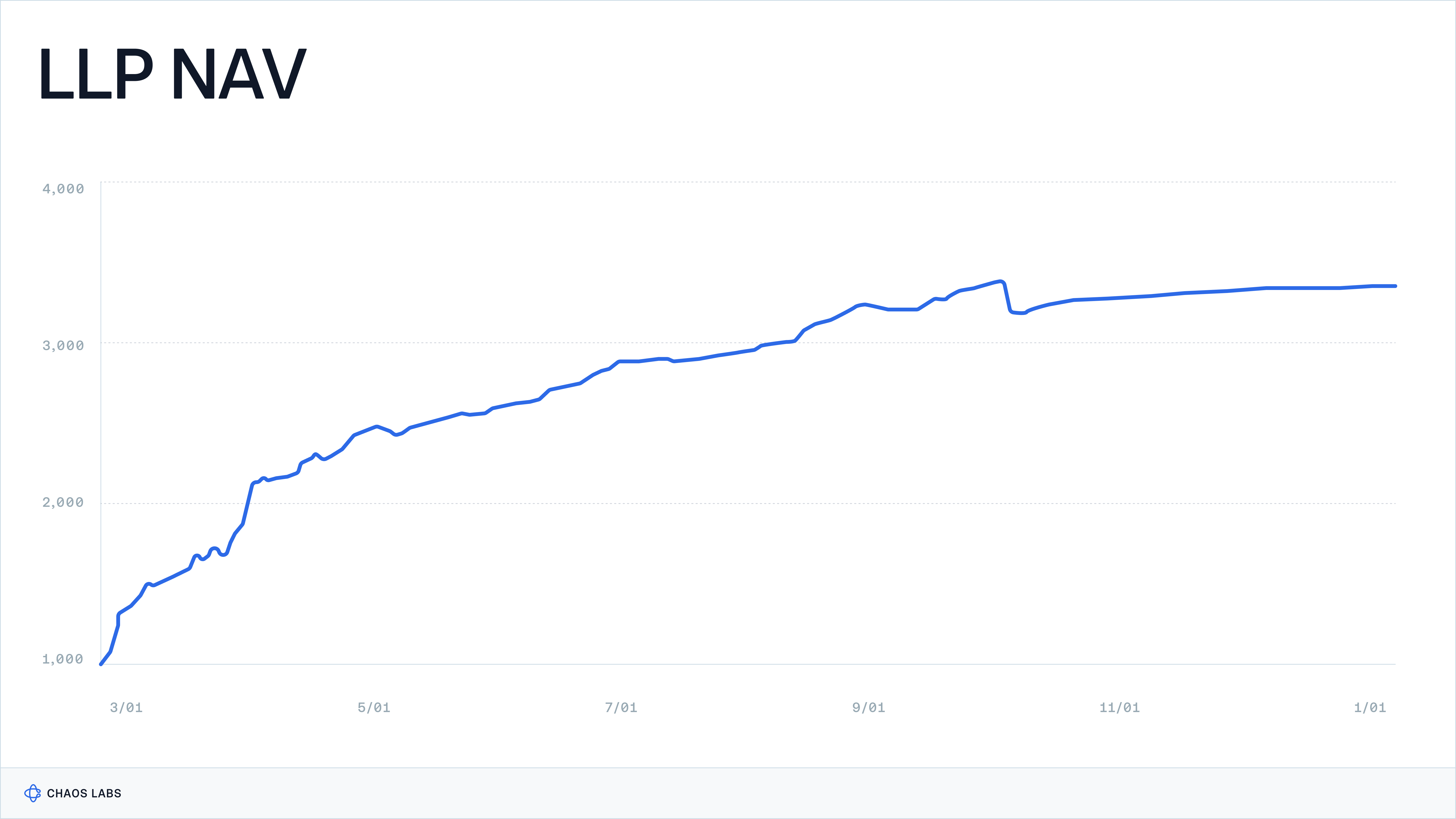

Even if one assumes (and this is already a huge assumption) that an MM vault has a positive expected edge over a long horizon, this edge does not translate into a smooth, bond-like return stream.

Market makers and LPs exist in a path-dependent space. Vaults can experience extended periods of small, steady gains, but even high-performing examples such as Hyperliquid’s HLP and Lighter’s LLP, despite strong historical Sharpe ratios, have suffered sharp drawdowns when volatility regimes shifted, order flow became adverse, or single-tail events occurred, such as on October 10, 2025. Aside from the risks, from the user’s point of view, this also matters for another reason: timing risk. If a vault’s NAV is in drawdown precisely when liquidity is needed, losses must be realized.

When The House ceases to be The House

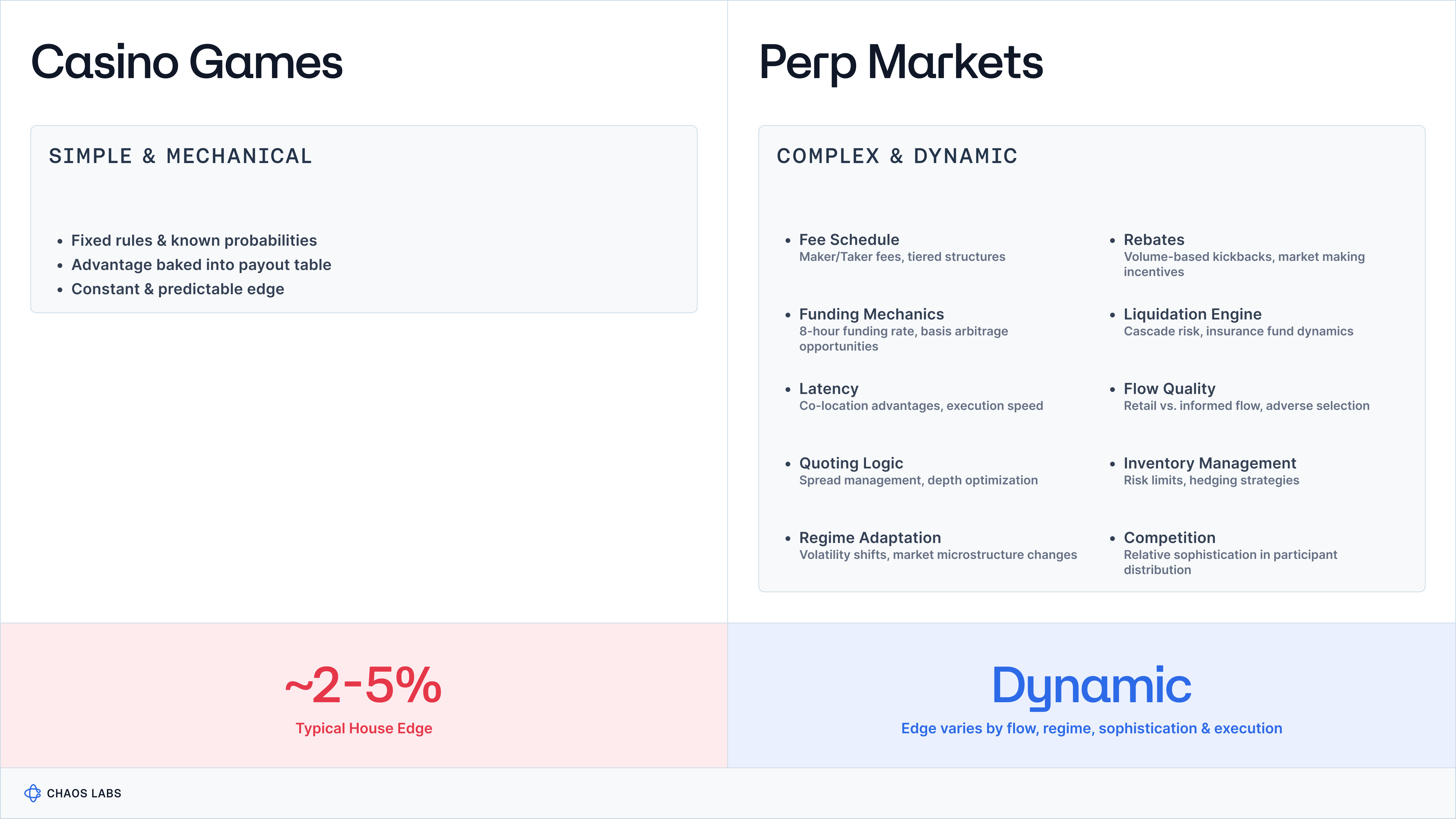

In casino games like roulette or blackjack, the house edge is simple and mechanical. The rules are fixed, the probabilities are known, and the casino’s advantage is baked into the payout table. Perp markets are not that kind of game.

The “house edge” is the result of several moving parts: fee schedule, rebates, funding mechanics, liquidation engine, latency, flow quality (mix of retail flow vs. informed flow), quoting logic, inventory management, how quickly the strategy adapts to new regimes and competition.

Is the vault on the sophisticated side of the participant distribution?

The last point is often underappreciated.

A public MM vault is a pool of capital and liquidity. If the underlying strategy is not extremely well designed and continuously maintained, it risks becoming the “dumb” LP that traders, faster market makers, and cross-venue arbitrageurs systematically trade against.

At this point, the house ceases to be the house.

It becomes a transfer mechanism to more sophisticated traders. Defensive responses are typically mechanical: widening spreads, raising fees, or tightening risk limits. These measures may stabilize the vault, but they often degrade execution quality and platform health.

Conclusion: There’s No Free Meal

MM vaults on perp DEXs are a powerful piece of financial engineering.

They package complex activities, such as market making and liquidation capture, into a single deposit interface and translate them into a headline APY (in addition to points and airdrops).

However, it is important to realize that the fundamental relationship never changes: yield is the price of risk.

Even vaults with a genuine structural edge can remain underwater for extended periods. This also doesn’t mean that MM vaults are inherently bad products.

On the contrary, they could be perceived as great products for users who:

- Understand how the strategy makes and loses money

- Can tolerate drawdowns and longer recovery paths

- Size positions as part of a broader risk budget rather than as “cash+”

There is no risk-free yield in DeFi.

Every single yield is a combination of financial engineering and mechanics for warehousing risk, each with distinct paths, edges, and payoff profiles. MM vaults belong in that spectrum, but not in the same bucket as emergency liquidity or a t-bill ladder.

For more on structured product risk in DeFi, see our previous analysis: DeFi's Black Box: How Risk & Yield Are Repackaged.

Aave Emerges Net Positive After Market Stress

A 10–20% market drawdown triggered elevated liquidations across Aave, with $202.47M of collateral seized against $193.12M of repaid debt over the 7-day period. On a net basis, liquidation activity was economically positive for Aave, with SVR revenue alone exceeding deficit realization.

(Part 3) The Missing Surfaces: What Google Doesn’t Know About Capital Markets

Markets operate on surfaces that never touch the open web. These aren't just "private data", they're fundamentally different data primitives requiring specialized infrastructure to observe and interpret.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.