Arch Network Integrates Chaos Price Oracles

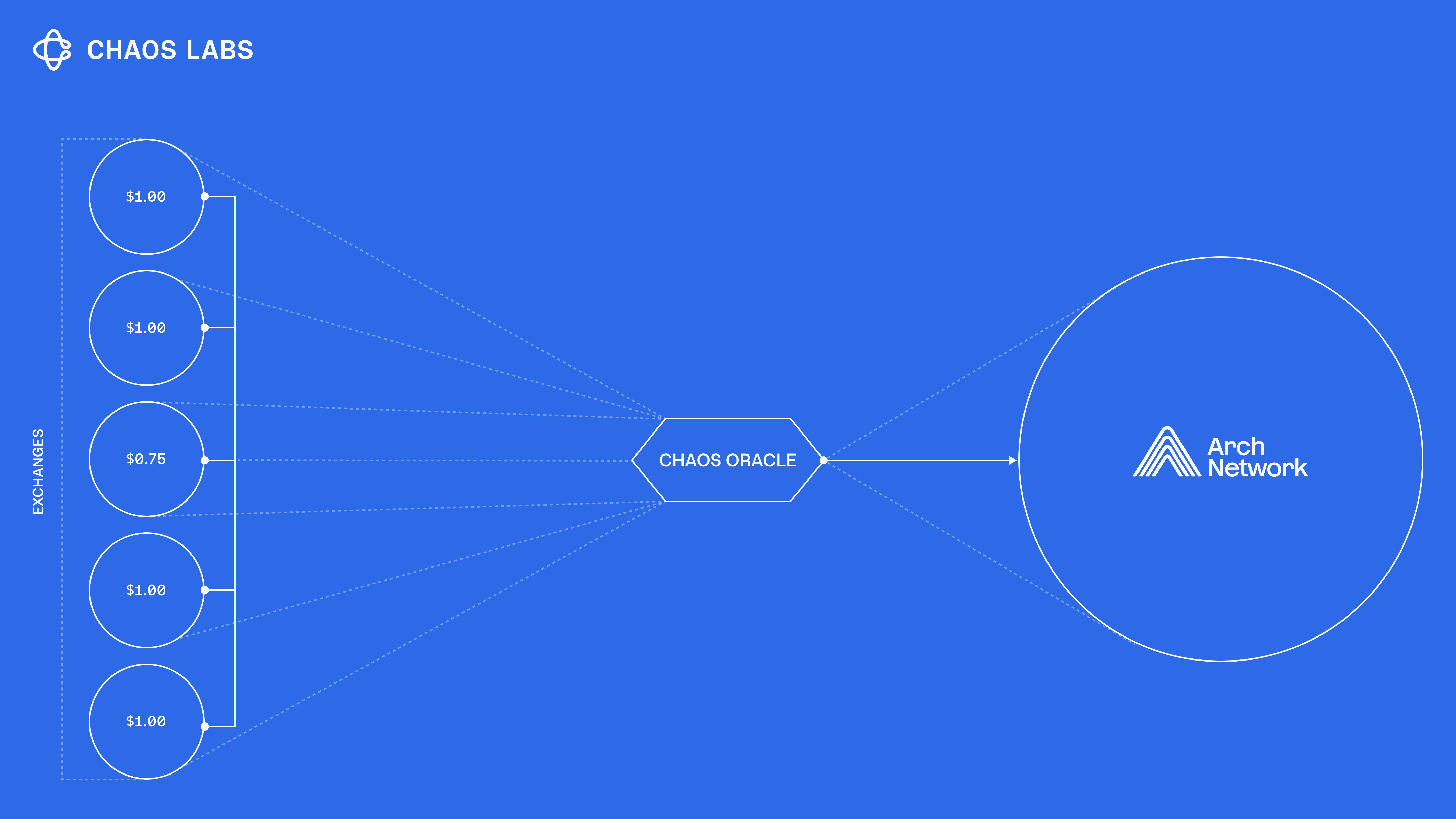

Chaos Price Oracles is the primary oracle provider for Arch Network, delivering institutional-grade price and risk infrastructure for Bitcoin DeFi.

The first integration: Autara Finance, a Bitcoin-native money market built on Arch, will use Chaos Price Oracles to enable secure lending, borrowing, and liquidations with sub-second precision.

Chaos Price Oracles

With over $300B in secured volume, Chaos Price Oracles bring institutional-grade reliability and scale to Bitcoin DeFi. Autara’s peer-to-pool money market depends on precise, high-frequency pricing to maintain safe collateral management and efficient liquidations.

Chaos Price Oracles are engineered to meet these demands with:

- Integrated Risk Management Systems: Detect and mitigate price manipulation across Bitcoin markets.

- Low-Latency Data Delivery: Sub-second updates critical for high-volatility Bitcoin assets.

- High-Frequency Updates: Reliable pricing for BTC-based assets like Ordinals.

Once live, Autara will benefit from fair and secure liquidations that preserve the algorithmic solvency of the protocol.

Strengthening Bitcoin DeFi

As the primary oracle provider for Arch, Chaos Price Oracles bring institutional-grade risk infrastructure to Bitcoin-native protocols.

As Bitcoin liquidity and demand grow, Autara and future Arch-based apps will operate with greater precision and risk control, supported by real-time, manipulation-resistant pricing, while preserving Bitcoin’s native security guarantees.

USDT0 Integrates Chaos Proof of Reserves

USDT0 has integrated Chaos Labs’ Proof of Reserves (PoR), bringing onchain, independent monitoring and reserve verification to the stablecoin.

Tydro (Ink) Integrates Chaos Price Oracles

Tydro is live on Ink and is the first Aave whitelabel deployment to use Chaos Price Oracles as its exclusive price feed provider.

Risk Less.

Know More.

Get priority access to the most powerful financial intelligence tool on the market.